When you work with vendors, ensuring that they have adequate insurance coverage is crucial for safeguarding your business.

A Certificate of Insurance (COI) for vendors is a key document that provides proof of their insurance coverage.

In this blog, we’ll explore:

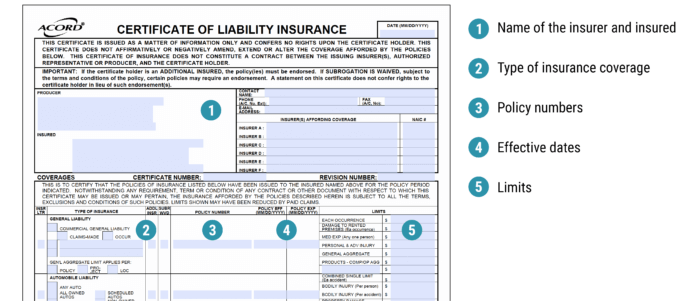

A Certificate of Insurance for Vendors is a standardized document that serves as proof of a vendor’s insurance coverage.

This document is issued by the vendor’s insurance company and contains essential information, including:

When you request a COI from a vendor, you gain access to these details, providing assurance that insurance protection is in place to mitigate risk.

Working with vendors carries potential liability for your business. Whether it’s related to materials, equipment, or services, vendors can introduce risks.

The COI acts as a safety net, shifting the responsibility for these risks from your business to the vendor’s insurer.

Collecting COIs from vendors is also essential for quick access to information when risks arise. Instead of waiting for vendors to share their entire insurance policies, you can request a COI with all the necessary information, saving valuable time when addressing accidents or incidents.

Requesting a Certificate of Insurance from a vendor is a fundamental step in ensuring your business’s protection. Here are the six steps to request a certificate of insurance from a vendor:

Insurance requirements can vary by state, and different states have their own laws and regulations.

For example, in some states, like Indiana, specific exemptions related to workers’ compensation insurance apply.

It’s essential to stay informed about the insurance laws and standards in your state and any state where your vendors operate. Consulting with your insurance broker can be a valuable resource for understanding state-specific requirements.

The need for a Certificate of Insurance for business depends on your role in the business relationship. If you’re the requesting business, you must ensure that your vendors have the necessary coverage to protect your company from risks.

You’ll also need to verify the authenticity of the certificates to guard against fraudulent or inaccurate documentation.

On the other hand, if you’re a contractor or vendor providing the COI, work with your insurance broker to meet the coverage requirements specified by the requesting business.

Ensure that the COI accurately reflects your insurance coverage and limitations.

A common format for a Certificate of Insurance is the ACORD 25 general liability insurance form . The form is typically filled out by the insurance agent or agency, and it includes fields for essential information.

As a business that receives COIs, having a library of templates or samples can be useful for quick reference.

However, it’s crucial to verify the accuracy and validity of the information provided in the COI.

Certificates of Insurance can be complex, and questions often arise.

To address issues related to COIs, it’s essential to consult your company’s risk management department or general counsel for guidance. These internal resources can provide a certificate of insurance review checklist to ensure compliance with your company’s requirements.

When you have questions about the coverage, exclusions, or limitations mentioned in a COI, always contact the insurer who issued the certificate for accurate information.

Relying on the third party who provided the certificate may lead to misunderstandings or errors in coverage.

In conclusion, requesting a Certificate of Insurance from vendors is a critical step in managing risk and protecting your business.

It’s essential to understand the requirements, use templates or sample letters for consistency, and maintain accurate records to ensure compliance and reduce potential liabilities.

By following best practices and staying informed about insurance regulations, you can streamline the process and enhance your business’s risk management strategies.